State Senator Brad Hoylman-Sigal of Manhattan is encouraging JP Morgan Chase & Co. to bolster protections against fraud and reimburse victims following reports of a string of robberies in and around his district involving attackers who have used e-pay platforms like Zelle to steal thousands of dollars.

Multiple news reports and the police have sounded the alarm in the last year of attackers drugging victims — sometimes fatally — after meeting them at or near gay bars. Once victims are incapacitated, the assailants have allegedly used the iPhone’s face ID feature to unlock their phones and steal from their bank accounts using Zelle. Survivors have often tried unsuccessfully to recover the funds from their banks despite a 1978 federal policy — known as Regulation E — that requires financial institutions to protect individuals from unauthorized electronic transfers.

Hoylman-Sigal sent a letter to JPMorgan Chase & Co. CEO Jamie Dimon encouraging the bank to take action after one of the state senator’s constituents complained because he could not retain funds from Chase after his money was stolen through Zelle.

“Thankfully, he survived the attack, but he has yet to be reimbursed by Chase for his loss, which constitutes the vast majority of his savings, even though he promptly filed a fraud claim,” Hoylman-Sigal said in the letter.

Zelle is operated by Early Warning Services LLC, which is jointly owned by seven large American banks — JP Morgan Chase, Bank of America, Capital One, PNC, Truist, YS Bank, and Wells Fargo. Hoylman-Sigal cited research showing that just 47% of money stolen through Zelle gets recovered.

The state senator said in the letter that he wants e-play platforms to provide an early warning to banks and authorities to deter criminals. He encouraged banks to take other steps to bolster protections, such as implementing a two-factor authentication for large transfers.

“Chase should immediately change its fraud policy and implement stringent safeguards in connection with e-pay platforms, particularly in light of the series of shocking incidents at LGBTQ bars and nightclubs in my Senate district where individuals apparently have been preyed upon, incapacitated against their will, and robbed through fraudulent transfers on Zelle,” Hoylman-Sigal said in a written statement.

In response to the robbery cases, members of the City Council’s LGBTQIA+ Caucus and the Mayor’s Office of Nightlife joined together for a recent webinar to encourage folks to turn off facial ID on their phones before going to gay bars in the city.

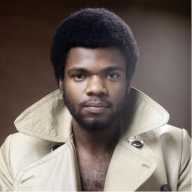

One of the most prominent cases in the string of robberies involved 25-year-old Julio Ramirez, who was drugged and later died in a cab last year after leaving the Ritz, a gay bar at 369 West 46th Street. Around $20,000 was taken from Ramirez’s accounts through Zelle and ApplePay, and his family has not been able to get the money back. Arrests have been made in connection to some of the robberies, but other cases — including Raimirez’s — remain unsolved.

“As these platforms are being exploited by wrongdoers in the most appalling of circumstances, creating a heightened level of public concern, I hope you hasten action to change your fraud policies and reimburse these victims and their families as soon as possible,” Hoylman-Sigal wrote.

A spokesperson for the company that runs Zelle placed the responsibility for the lost money on the banks, telling Gay City News that “we don’t actually hold the funds.”

“It’s up to banks to do a thorough investigation and decide whether to reimburse,” said Meghan Fintland, a spokesperson for Early Warning Services, LLC.

Chase did not respond to a request for comment, but JP Morgan’s head of US government relations, Michelle Mesack, delivered a letter to US senators last year defending Chase’s actions in relation to Zelle. Mesak claimed that “both fraud rates and overall fraud” associated with Zelle “decreased over time due to fraud prevention and detection techniques implemented by banks like Chase.”

“When bad actors are detected, Zelle’s participant institutions restrict access to Zelle and report the transaction to the network for further monitoring and action. We reimburse customers for unauthorized transactions reported in a timely manner. For 2022, we reimbursed an average of $ 1.7 million each month for unauthorized payments.”