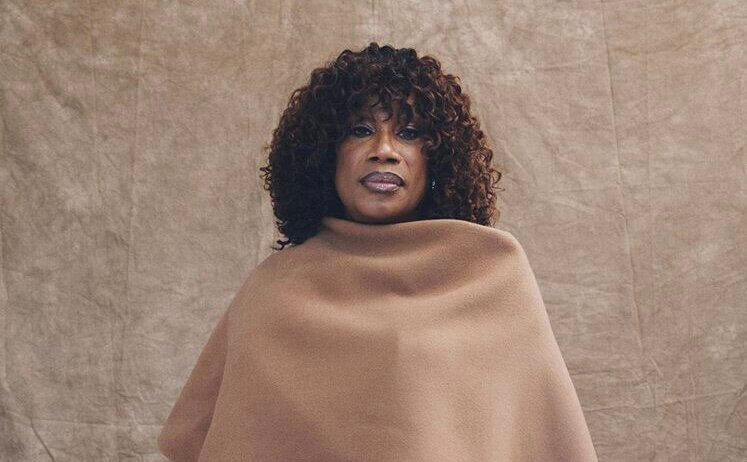

In November of 2020, Ceyenne Doroshow, the founder and executive director of Gays and Lesbians Living in a Transgender Society (GLITS), opened a building for low-income transgender and queer New Yorkers to call home. GLITS bought the $2.5 million 12-unit building in Queens in July 2020, just before New York’s housing prices took a breathtaking leap upward after the dramatic pandemic plunge.

GLITS was able to purchase the building thanks to a capital campaign supported by a couple of large anonymous donors and many individual donations, she said.

More than two years later, Doroshow is still in disbelief about the challenge that she faced to acquire the building as a Black transgender woman.

“It was daunting. There were some points when I was crying. I’m still crying,” she said. “I did it with a caring heart and a loving mind. If I had to do it again, I would.”

The first three new residents moved into the building in April 2021. Now, only 2% of the building is occupied by tenants the organization inherited, Doroshow said. Many of the former longtime occupants of the building moved out and new tenants selected by GLITS moved in.

Doroshow said that the building can serve as “a blueprint for other trans women and leaders to do the same thing.”

Low homeownership rate

LGBTQ people have an estimated $1 trillion purchasing power in the real estate market, but the reality is that queer and transgender homeowners have a much lower homeownership rate than the general population.

According to a report by Freddie Mac, the LGBTQ+ Real Estate Alliance, the Williams Institute, and other organizations, the queer homeownership rate is only 49% compared to 65% within the general population.

Jody Herman, an out lesbian senior scholar of public policy at the Williams Institute, told Gay City News that the rate of home ownership without a loan or mortgage was only 12.9% among transgender people compared to 25.5% for cisgender people. For those who owned a home carrying a loan or mortgage, the rate was only 30.9% for transgender people and 44.8% for cisgender people.

Fifty percent of transgender people rented compared to 28% of cisgender people, Herman added.

“It’s not surprising that we would find lower homeownership rates amongst trans folks,” she said. “There are some real challenges that the population is experiencing.”

Herman said when looking at the data that researchers do have on transgender people overall, “the barriers can be kind of pervasive across different areas of life.”

Doroshow knows those barriers well. The Brooklyn native is no stranger to homelessness, poverty, and substance abuse. In the 1980s, she became homeless for eight years and struggled with substance use. She recovered and became a fierce transgender advocate who found the strength to push back against negative stereotypes of transgender people, as well as abuse, discrimination, economic challenges, and more.

Transgender individuals are almost four times more likely than the general population to have household incomes well under the poverty level at less than $10,000 a year, according to a report by the National LGBTQ Task Force. The costs of homeownership can be difficult for transgender people to face without financial resources or family support. Discrimination, deadnaming, misgendering, and outing can serve as added stressors on the road to homeownership.

Researchers found in recent US Census data that trans people who rented or owned a home with a mortgage were less likely to pay a full energy bill in the past 12 months and “were much more likely than cis folks to have difficulty with household expenses.”

High housing costs and limited housing stock could persist for some time. Many potential LGBTQ homebuyers have bowed out of the tight market due to competition and pricing, leaving queer homebuyers more vulnerable, especially transgender people seeking homeownership.

According to the 2022 report from the same coalition of real estate and LGBTQ professionals, 76% of potential LGBTQ homebuyers reported home prices were the biggest barrier to homeownership. Affording a down payment in the first place was a challenge for 61.9% of respondents. Thirty percent of other potential LGBTQ homebuyers reported they were saving more for a down payment.

Pinklining

To avoid discrimination and to increase their earning potential, many LGBTQ employees seek out companies and states, like New York, that have strong protections in place for queer and transgender people. These places come with hefty price tags far above the national average cost of living.

Still, the vast majority of LGBTQ+ Real Estate Alliance members surveyed, 89.3%, report that they feel that it is at least somewhat important to live in a queer-friendly community.

According to the Freddie Mac and the LGBTQ+ Real Estate Alliance report, 90% of gender-expansive people reported being worried about gender identity discrimination while purchasing a home. The report also found that 10% of LGBTQ homeowners reported experiencing discrimination while looking for housing and 5% reported that a seller refused to sell to them. About 44% of transgender individuals said they had either experienced or suspected they were victims of discrimination. Less than a quarter, 23.4%, of members, did not report any discrimination.

The United States Supreme Court 2020 decision in Bostock v. Clayton County barred employment discrimination on the basis of sexual orientation or gender identity by expanding the definition of “sex” under Title VII to include sexual orientation and gender identity. President Joe Biden followed up the decision with an executive order in 2021 that made it illegal to discriminate against LGBTQ people in housing. Federal courts have often interpreted the Bostock ruling to extend beyond employment discrimination, but some conservative judges have viewed it as more narrow in scope.

Some states have protected LGBTQ people for years. New York is one of the states that have the most legal protections in place for transgender individuals, as outlined by the Transgender Law Center. According to Freedom for All Americans, 27 states lack any protections for LGBTQ people in employment, housing, and public accommodations,

Homebuying checklist:

Experts said the best way transgender homebuyers can be prepared for homeownership is to:

- Ensure your chosen name and gender marker is updated at every place in your life, from your birth certificate to Social Security to schools to past jobs to banks, credit reporting agencies, and the IRS.

- Make sure all financial documents — bank statements, credit reports, etc. — are correct beyond name and gender marker changes.

- Educate yourself about your rights and the homebuying and maintenance process.

- Build a qualified trusted team from your real estate agent, mortgage broker (Human Rights Campaign’s Corporate Equality Index or The National Chamber of Commerce), lawyer, and ask around for others to help guide and support you during the process.

To file a discrimination complaint, check with the appropriate agency:

- Fair Housing Office New York (often cheaper, faster, and may provide more protection than at the federal level)

- Department of Housing and Urban Development (complaints can only be filed one year from the date of the incident; include as many details as possible)

- National Credit Union Association

- Federal Reserve Board

- Comptroller of Currency