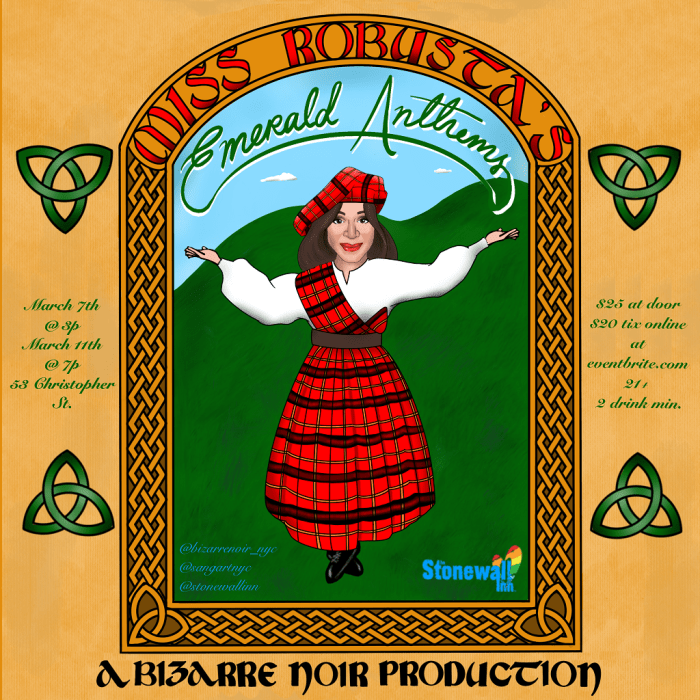

Treasury Secretary Jack Lew. | US TREASURY DEPARTMENT

The Treasury Department and the Internal Revenue Service have announced that legally married same-sex couples, regardless of the state where they reside, will treated as married for federal tax purposes.

The August 29 announcement is one of the most significant rulings out of the Obama administration since the Supreme Court on June 26 struck down that portion of the Defense of Marriage Act denying same-sex couples federal recognition.

The new policy means that even those married gay and lesbian couples whose home states do not recognize their marriage will be able to file joint federal tax returns as a married couple.

Treasury Department announces where a couple weds, not where they live key

“Today’s ruling provides certainty and clear, coherent tax filing guidance for all legally married same-sex couples nationwide,” Treasury Secretary Jacob J. Lew said in a written statement. “It provides access to benefits, responsibilities, and protections under federal tax law that all Americans deserve. This ruling also assures legally married same-sex couples that they can move freely throughout the country knowing that their federal filing status will not change.”

The announcement made clear that “same sex couples will be treated as married for all federal tax purposes, including income and gift and estate taxes. The ruling applies to all federal tax provisions where marriage is a factor, including filing status, claiming personal and dependency exemptions, taking the standard deduction, employee benefits, contributing to an IRA, and claiming the earned income tax credit or child tax credit.”

Couples will be considered legally married as long as they wed in one of the 13 states or the District of Columbia where marriage equality now exists, in any other states at such time when it becomes legal, or in any foreign jurisdiction, such as Canada, Spain, or Britain, where gay marriage is legal.

The ruling does not apply, the government warned, to couples in civil unions or registered domestic partnerships. As a result, the decision puts greater pressure on states like New Jersey, where Governor Chris Christie argues that civil unions deliver all the same rights and benefits as marriage.

“The fact that this new respect applies only to married couples — not those joined by domestic partnerships or civil unions — highlights the need for an America where everyone can marry the person they love in any state, and have that marriage respected at all levels of government,” said Evan Wolfson, president of Freedom to Marry, in a written statement.

The new policy also complicates matters for tax authorities in non-marriage equality states, since state filing status is often specifically linked to the filing status claimed on a taxpayer’s federal form. Legally married same-sex couples now have the obligation to file as married, jointly or separately, going forward.

Married couples who wish to amend past tax filings can typically go back three years.

The Treasury announcement follows on a series of other Obama administration rulings that have relied on the “place of celebration” — where a marriage took place — rather than state where a couple resides in determining whether the union is due federal recognition for one purpose or another. Shortly after the DOMA ruling came down, Janet Napolitano, the secretary of Homeland Security, announced that a similar approach would be applied to citizens who wish to win permanent residency for their same-sex immigrant spouse. That statement was backed up just weeks later by the Board of Immigration Appeals, which is in the Justice Department’s Executive Office for Immigration Review.

Actions such as that taken by Treasury and Homeland Security point up the critical role played by the Executive Branch in response to victories in the courts. The June Supreme Court ruling left many specific questions about federal recognition of same-sex marriages uncertain, and President Barack Obama pledged to deliver answers as sweeping as possible. With the new Treasury/ IRS policy, the administration is continuing down that road.