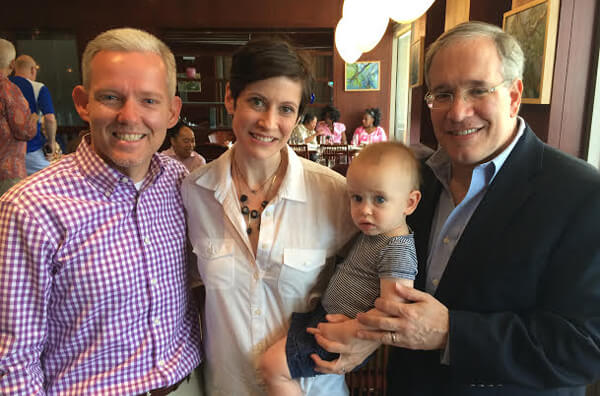

As part of his office’s partnership with an opioid accountability group, Comptroller Scott Stringer is pushing Gilead to embrace a “clawback” policy under which the corporation’s board of directors would recoup compensation from top executives engaged in wrongdoing.

Stringer and New York City Employees’ Retirement Systems, in conjunction with Investors for Opioid and Pharmaceutical Accountability (IOPA), asked for the policy in a shareholder proposal submitted to Gilead’s board of directors on November 13 after the pharma giant — which produces HIV prevention and treatment medication — was hit with a lawsuit from the US government for patent infringement. It is also one of four pharma giants being sued in a class action case alleging price rigging.

As comptroller, Stringer is an investment advisor and trustee of the New York City Pension Funds, which includes not just the New York City Employees’ Retirement System but also the Teachers’ Retirement System, the New York City Police Pension Fund, the New York City Fire Department Pension Fund, and the Board of Education Retirement System — making it one of the nation’s largest institutional investors. Those systems own stock in Gilead and, according to the shareholder proposal submitted by the city, “each system intends to continue to hold at least $2,000 worth of these securities through the date of the company’s next annual meeting.”

The proposal would be withdrawn if the company enacts the clawback policy at the next annual meeting.

Stringer is using the proposal as a way to show investors that ethical practices lead to financial stability and growth in the long run. Stringer told Gay City News in a phone interview that Gilead’s actions “punishes the LGBTQ community” and he ripped the corporate giant for charging extraordinarily high prices for drugs — including HIV prevention medication known as PrEP — that cost just a few dollars in other countries.

“What I found so disgusting is that the drug costs are $2,000 in the US and only $8 in Australia,” Stringer said. “We go in when we want to stop something bad from happening and the best way to do that is to enact clawback policies that hold the highest people accountable. You’re not going to make personal money and act in ways that hurt people. This conduct is totally outrageous.”

The comptroller’s office is one of 59 members of the IOPA’s broad coalition of public, faith-based, labor, and sustainability funds that engage with numerous manufacturers, distributors, and retail pharmacies to address opioid oversight practices. Among other initiatives, the coalition files shareholder resolutions and seeks reports to investors on how the board is evaluating risks. Gilead is one of many companies IOPA will focus on in 2020 and the comptroller’s office took the lead on engaging with the corporation, according to those involved in the coalition.

“Gilead was one of those selected because of some of their anti-competitive practices,” Donna Meyer, a co-leader of the coalition, told Gay City News in a written statement. “Investors hope Gilead will agree to adopt a clawback and disclosure policy so the resolution can be withdrawn. Most pharmaceutical companies with whom we work already have such a policy. However, if the company does not agree, resolutions like this usually go on the company’s proxy so all shareholders have an opportunity to express their views.”

The comptroller’s office has had success seeking clawback policies in the past — most notably when convincing Wells Fargo in 2013 to embrace such a policy that eventually led to clawbacks totaling $75 million from a pair of executives there who were embroiled in an accounts-related scandal. In total, Stringer has submitted 18 clawback-related proposals, 11 of which have been enacted.

In this case, however, it is not clear whether the board would move ahead with a clawback policy in the face of legal action targeting Gilead. When asked about that, Stringer only said, “Let’s see how it plays out.”

Gilead did not respond to a request for comment on the proposal.

Whether the policy is adopted or not, Stringer believes the proposal at least sends a message that investors are prioritizing financial stability — and he hopes it will resonate.

“We’ve come so far, we can’t allow these companies to take advantage,” he said.