House hunters searching for a new home have been increasingly worried since a perfect storm brewed this year to push the dream of homeownership out of reach for many people.

Swiftly rising interest rates have climbed to the highest level they’ve been in 13 years, hitting 5.2% amid skyrocketing inflation, and a tightening housing market has been compounded by international unrest, supply shortages, near-future economic uncertainty, and stock market volatility, according to economists.

This is starting to scare off would-be homebuyers. Declines in median existing-home sales and mortgage applications are reflecting people’s uncertainty or the fact that buying has simply been snatched just beyond their reach.

In April, existing-home sales dropped by 2% from the prior month and 5.9% from one year ago, according to the National Association of Realtors’ May 19 report. Demand for existing-home sales fell for the third consecutive month this year, the association noted in a May 19 news release. The day before, the Mortgage Bankers Association reported that home mortgage loans dropped by 11% compared to the week before, according to its May 18 news release.

The storm is slowing New York City’s recent white-hot housing market, hitting broker confidence, which fell for a third straight quarter, and dampening brokers’ outlook for the rest of the year, the Real Estate Board of New York, the city’s leading real estate trade association, reported May 16.

To buy or not to buy?

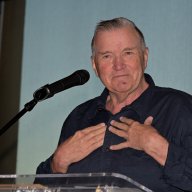

These issues, along with rising costs, aren’t stopping some buyers from buying, nor should it, mortgage lender Donald Sharpe told Gay City News.

As a loan originator, Sharpe helps people become homeowners from the application process to closing on their dream homes.

The 64-year-old gay senior loan officer at Movement Mortgage has seen it all during his 35-year career in the mortgage industry. The federal government’s interest rate hike and the next and final one for 2022 — coming in June — are not the highest the rates he’s seen during his career, he said.

“I just simply advise people not to get caught up in the fever,” Sharpe said. “Only buy something that seems reasonable.”

Reasonable to him is looking at the bigger picture. Last week’s 5.2% interest rate increase on a 30-year fixed-rate mortgage over 20 years isn’t as much as it could be and has been in the past.

“By no means [is the current interest rate] on the highest end of it at all,” he said, pointing out that during his career there have been many years where interest rates have been 6% and 7%.

“People will continue to buy homes in practically any interest rate market,” he said, especially when comparing the cost and value of renting versus owning. “Rent prices are way, way up all over the country,” so “anytime is a good time to buy. It’s not really any cheaper to buy a home than it ever was, but compared to how much you’d have to pay for rent it makes it more reasonable.”

Even when interest rates go down, the property price will have risen, he said.

He also believes buyers need to consider that they are not “marrying the payment.”

There’s a gamble that the payment might be higher than the rent the buyer is currently paying, he said, but the odds are decent that the home will be refinanced to a lower payment at some point. The benefit is “you will have already owned it” and the home would have appreciated.

Sharpe also pointed out that many buyers don’t consider the tax write-offs and government subsidies to help people buy homes. They also don’t consider the house payment isn’t the largest expense compared to other expenses, such as repairs and renovations, that come with homeownership, he added.

Experience

Sharpe got into the mortgage industry in his mid-20s in 1987. The independent mortgage firm that handled his mortgage for his first home offered him a position in Tampa, Florida.

“It wound up working out really, really well,” said Sharpe who eventually owned his own mortgage company for 20 years and worked in Georgia, Illinois, Texas, and California. He sold the company to his employees in 2010 and went on a three-year sabbatical to recover from the housing market crash of 2008.

Several years later, he moved to New York to live out a dream to call the city home and reinvent himself as a real estate agent. Soon, mortgage companies started knocking on his door. Sharpe works with real estate agents to help clients fiend the mortgage that is a perfect fit for them.

“I finally gave in to the lure of the siren song of the mortgage business, which is what I had really loved,” he said.